Take Charge of Your Finances with SoFi

SoFi empowers you to manage your money smarter, whether it’s refinancing student loans, applying for personal loans, growing your investments, or banking with high-yield accounts. Join over 12 million members achieving financial confidence and long-term success with SoFi’s all-in-one financial platform.

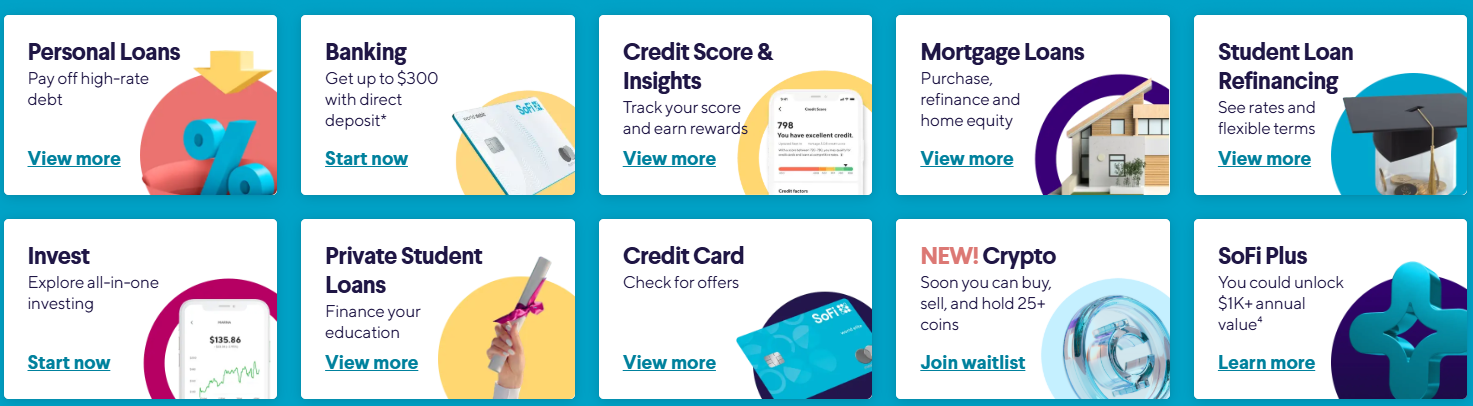

- Loans Made Simple: Student, personal, or refinancing options with competitive rates

- Banking & Rewards: High-yield savings, checking, and credit card benefits

- Investing & Retirement: Grow your wealth with automated or self-directed investing

- Member Perks: Exclusive financial guidance, events, and SoFi rewards

Take Control of Your Finances

with SoFi’s All-in-One Platform

SoFi helps millions of members achieve financial freedom with tools and services for loans, banking, investing, and credit management. Whether you’re refinancing student debt, opening a high-yield savings account, or starting your investment journey, SoFi provides simple, secure, and effective solutions.

From personalized loan options to expert financial planning, SoFi makes managing your money effortless. Enjoy flexible terms, transparent rates, and tools that help you make smarter financial decisions every day.

Join SoFi today and unlock benefits like rewards points, exclusive member experiences, and resources designed to help you grow your wealth and plan for your future—all in one trusted platform.

How SoFi Helps You Achieve Financial Freedom

Managing your money doesn’t have to be complicated. Discover how SoFi’s tools and services guide you step by step toward smarter financial decisions and long-term growth.

Sign Up and Explore Your Options

Start by creating your free SoFi account. Browse products like student loan refinancing, personal loans, mortgages, or investment accounts to find solutions tailored to your financial goals.

Choose the Right Product for You

Whether you want to refinance student debt, open a high-yield savings account, or invest in stocks and ETFs, SoFi provides clear guidance, competitive rates, and flexible terms to suit your needs.

Access Expert Guidance & Tools

Get personalized financial advice from SoFi experts, use calculators and dashboards to track spending, investments, and loan payments, and receive tips to optimize your finances safely and efficiently.

Enjoy Financial Confidence & Rewards

With SoFi, manage all your finances in one place. Earn rewards, track your credit score, and take advantage of member benefits like exclusive experiences and financial planning—helping you stay on track toward your goals.

SoFi – Empowering Your Financial Journey

SoFi is a leading personal finance platform dedicated to helping individuals take control of their money and achieve financial freedom.

From student loan refinancing and personal loans to investing and mortgages, SoFi provides tools and solutions designed to simplify your financial life.

At SoFi, we tailor our products to meet your unique needs. Whether you're paying off debt, saving for the future, or investing in your goals, our easy-to-use platform and expert guidance help you make smarter financial decisions.

With competitive rates, transparent terms, and flexible plans, managing your money has never been more convenient.

Our mission is to empower you with knowledge, resources, and personalized support. Members benefit from credit score monitoring, budgeting tools, investment insights, and access to financial planners, ensuring you stay on track toward your goals.

Trusted by millions nationwide, SoFi combines innovative technology with expert advice to help you reach your financial aspirations with confidence.

Start your journey today and experience smarter banking, lending, and investing—all in one secure platform.

We Take Your Financial Security Seriously

SoFi is a trusted leader in personal finance, offering a comprehensive platform for banking, investing, loans, and more. Our secure, user-friendly tools help you manage your money confidently and make smart financial decisions—whether it’s paying off debt, saving for the future, or investing in your goals.

With SoFi, managing your finances is simple and convenient. Access personalized loan options, high-yield savings accounts, investment accounts, and credit monitoring—all in one secure platform. Every feature is designed to give you control over your money while keeping your data and finances safe.

SoFi puts you in charge of your financial journey. Track your spending, plan for major life events, and take advantage of expert guidance whenever you need it. Our goal is to help you achieve financial freedom and long-term security, all while making the process seamless and stress-free.

Why Millions Trust SoFi for Their Finances

SoFi made managing my finances simple and stress-free. Their app is intuitive, and the financial planning tools helped me pay off debt faster and start investing confidently.

SoFi’s personalized loan options fit my busy lifestyle perfectly. From student loan refinancing to personal loans, everything was clear, transparent, and tailored to my needs. I finally feel in control of my financial future.

I’ve tried multiple financial platforms, but SoFi stands out with its all-in-one approach. Banking, investing, and credit monitoring in a single app makes managing money easy and efficient. Their support team is always helpful and responsive.

Refinancing my student loans with SoFi was straightforward and fast. The team guided me step by step, and I could track my progress in real time. I’m saving hundreds of dollars every month, and it feels amazing.

SoFi’s investing tools helped me start building a retirement plan even with a busy schedule. The educational resources and easy-to-use interface give me confidence that I’m making smart financial choices for the long term.

Top Features of SoFi – Smarter Financial Solutions

SoFi empowers millions of members with tools and services to take control of their finances. From loans and investing to banking and insurance, SoFi makes managing your money simple, fast, and reliable.

Smart Student Loan Refinancing

Refinance your student loans at lower rates and save money each month. SoFi offers tailored options for undergrad, graduate, medical, law, and MBA loans.

Flexible Personal Loans

Borrow money for debt consolidation, home improvements, travel, or special occasions with transparent terms and competitive rates, tailored to your financial goals.

High-Yield Banking

Earn more with SoFi Checking & Savings accounts, enjoy fee-free banking, and get access to early direct deposits, high interest rates, and seamless mobile management.

Investing Made Easy

Grow your wealth with SoFi Invest. Access automated investing, self-directed trading, ETFs, stocks, fractional shares, and retirement accounts—all in one platform.

Member Rewards & Benefits

Earn points for financial achievements, unlock SoFi Stadium perks, enjoy travel discounts, and access exclusive events. SoFi rewards your smart financial moves.

Comprehensive Financial Planning

Get personalized guidance from certified financial planners. Plan for retirement, manage debt, and create a long-term strategy to achieve your money goals confidently.

SoFi – Frequently Asked Questions

Discover how SoFi helps you manage your finances, save money, and achieve your financial goals. Find clear answers about loans, banking, investing, and member benefits.

1. What is SoFi?

SoFi is a modern financial platform that provides loans, banking, investing, insurance, and financial planning tools. It helps members manage money efficiently, build wealth, and achieve long-term financial success.

2. Who can use SoFi services?

SoFi services are available to anyone looking to refinance loans, invest, bank, or plan for the future. Membership is open to individuals across supported regions, with exclusive perks for members.

3. What types of loans does SoFi offer?

SoFi provides student loan refinancing, personal loans, home loans, and auto loan refinancing. Each product comes with competitive rates, flexible terms, and tools to help you save money.

4. How does SoFi Invest work?

SoFi Invest lets you trade stocks, ETFs, and fractional shares, or automate investing with robo-advisors. Members can also invest in retirement accounts (IRAs) and explore IPO opportunities.

5. What banking services does SoFi provide?

SoFi offers high-yield checking and savings accounts with no fees, early direct deposits, and seamless mobile access. Members earn more interest while enjoying secure and convenient banking.

6. What are SoFi member benefits?

Members enjoy rewards for financial achievements, access to financial planners, exclusive SoFi Stadium perks, travel discounts, and unique experiences. SoFi rewards smart financial moves every step of the way.

7. How do I get started with SoFi?

Getting started is simple. Visit SoFi, create a free account, and explore the financial products you need. You can apply for loans, open accounts, or start investing in minutes.

8. Is SoFi safe and secure?

Yes. SoFi uses advanced security measures, FDIC insurance for banking balances up to $250,000, SIPC protection for investments up to $500,000, and 24/7 account monitoring to keep your money safe.